Learn - Create a demo account with us and give yourself a chace to understand the forex market. Once you are confident you can trade with real money.

Trade - Once you are confident you can go for live account trading and with the use of your skills and knowledge you can make profits.

Withdraw - All your profits can be withdrawn from anywhere in the world. We offer an instant withdrawal solution so that you don’t have to wait.

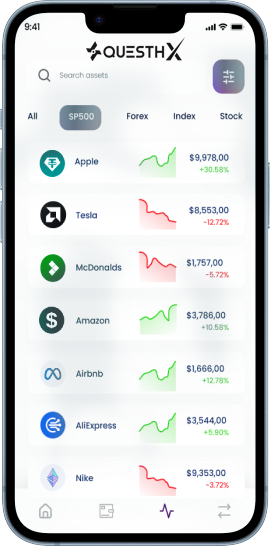

Trade And Manage Transactions From Anywhere

performance or general results of the various financial markets on a global scale. This assessment includes the behavior of assets, such as stocks, bonds, currencies and commodities, and is used to analyze global economic performance.

CFD trading is a type of trading that allows you to speculate on the price movement of financial instruments without actually owning the underlying asset. For example, traders can open a CFD account with a broker to trade stocks, indices, forex, commodities and more. Brokers offering CFD trading are in demand because CFDs allow you to trade on leverage, which means you can open a position with a fraction of the capital you would otherwise need to buy the underlying asset outright. CFD trading is also flexible, which means traders can use the same trading account to go long or short on a CFD depending on your market view.

A CFD trading platform is software that your broker offers to trade contracts for difference (CFDs) on financial markets. When you open a CFD account with Questh X or with one of the many other brokers, a platform is usually provided for free alongside the accounts. Platforms provide you with real-time market data and enable you to place and manage your trades, often with access to leverage to place trades on margin using a smaller amount of capital. Most CFD trading accounts have platforms that are web-based, so you can access them from anywhere in the world while the best brokers also offer mobile apps, so you can trade on the go. A Questh X account offers a number of options for the platform, including the Questh app and Questh X Pro desktop application.

There are a lot of CFD brokers and platforms to choose from, so it takes some digging to choose the best broker. Firstly, you need to consider what your goals are as a trader. What are you looking to trade? What markets are you interested in? How much risk are you willing to accept? Most new traders are categorised as retail traders. Retail traders trade for themselves and need a retail broker. Once you know this, you can start to narrow down your options. Next, you need to look at the features and functionality of platforms. What tools and resources does it offer? Does it provide real-time market data? What amount of leverage is available? Is it user-friendly? It is possible to find out what other traders think of a broker and its platform tools through online trading forums. Finally, you need to consider financial costs. All online brokers charge a spread on every trade but some CFD accounts charge commission on trades, some stipulate minimum deposit requirements while others offer different margin requirements or may have monthly fees or annual fees for use of data or different platforms.

When you trade CFDs, you don’t actually own the underlying asset. Instead, you are entering into a financial contract with your broker to speculate on how high or low the price of the asset will go. If the price moves in your favour, you will make a profit. The risk is that it can also move against you so you will have a losing trade. Your broker will add to or subtract from your account balance, according to the result of the trade. CFDs are a leveraged product, so you only need to put down a small deposit of money (margin) into your trading account to open a position. Using margin gives you the potential to make a much larger profit (or loss) than if you were to trade the asset outright. The use of leverage means a higher risk of losing more than your initial deposit.

Step by Step

Step by Step

Step by Step